How Tuzo Rewards Works

Earn

Turn Every Swipe Into a Reward. For the first time merchants can earn rewards on every transaction they process

Welcome to TUZO

Think credit card rewards but for merchants

Where every transaction processed is transformed into a rewarding experience.

Partner with Tuzo Today

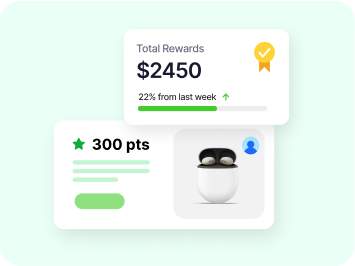

Merchants earn reward points for every dollar processed in their business.

A fully integrated platform that enables merchants to earn rewards without any changes to existing systems or equipment.

Earn Tuzo's RewardsRedeem and Spend Tuzo's Rewards.

Redeem your reward points by selecting from available gift cards, travel, luxury Goods, or exclusive deals directly from your Tuzo Rewards account—just click redeem and enjoy

Explore the Possibilities

Tuzo Benefits

An App That's Never Been Seen Before

Browse Our Rewards Categories

Redeem your points for travel, gift cards, cash back and more. Make the most of your

purchases and enjoy the rewards today!

Luxury Goods

Gift Cards

Experiences

Travel

Raffle

Electronics

Who We Are

The Tuzo team has spent over a decade working to create tools that enhance the merchant processing experience and bring value added services to merchants and ISO’s that do not currently exist.

Tuzo’s team includes industry veterans who were instrumental in the launch of many industry innovations including the technology behind one of the original cash discount programs released in the USA.

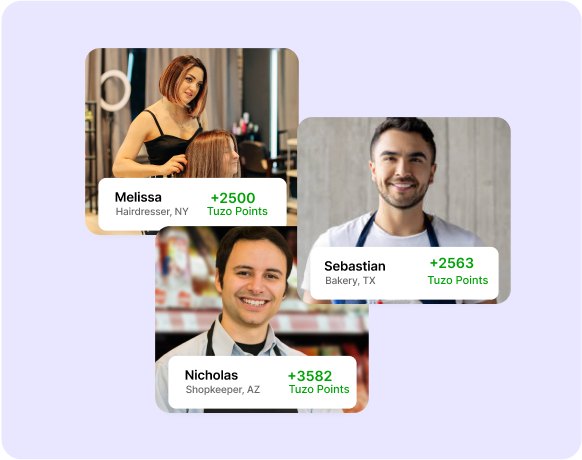

More about Tuzo RewardsHear from earning customers

See the results customers are getting after partnering with Tuzo.

Tuzo made my processing feel like an investment, not a cost.

I love earning points on every transaction! I used to feel like I paid for my customer's points and now I'm the one earning..

I'm saving up for a Rolex! I'm aiming for a gold watch my wife won't let me buy!

I literally check my points everyday. I can't believe I didn't start earning until now!

When the sales guy told me about this I actually didn't believe him, but now I told all of my friends that they're crazy not to sign up.

Sign up with one of our trusted partners and start

earning rewards today.

Finally a platform that rewards merchants for every dollar.

Get Started for free